Publications

Environmental and economic concerns surrounding restrictions on glyphosate use in corn.

Ziwei Ye, Feicia Wu, and David A. Hennessy. 2020. Proceedings of the National Academy of Sciences, 118 (18).

Abstract

Since the commercialization of transgenic glyphosate-tolerant (GT) crops in the mid-1990s, glyphosate has become the dominant herbicide to control weeds in corn, soybean, and other crops in the United States and elsewhere. However, recent public concerns over its potential carcinogenicity in humans have generated calls for glyphosate-restricting policies. Should a policy to restrict glyphosate use, such as a glyphosate tax, be implemented? The decision involves two types of tradeoffs: human health and environmental (HH-E) impacts versus market economic impacts, and the use of glyphosate versus alternative herbicides, where the alternatives potentially have more serious adverse HH-E effects. Accounting for farmers’ weed management choices, we provide empirical evaluation of the HH-E welfare and market economic welfare effects of a glyphosate use restriction policy on US corn production. Under a glyphosate tax, farmers would substitute glyphosate for a combination of other herbicides. Should a 10% glyphosate tax be imposed, then the most conservative welfare estimate is a net HH-E welfare gain with a monetized value of US\$6 million per annum but also a net market economic loss of US\$98 million per annum in the United States, which translates into a net loss in social welfare. This result of overall welfare loss is robust to a wide range of tax rates considered, from 10 to 50%, and to multiple scenarios of glyphosate’s HH-E effects, which are the primary sources of uncertainties about glyphosate’s effects.

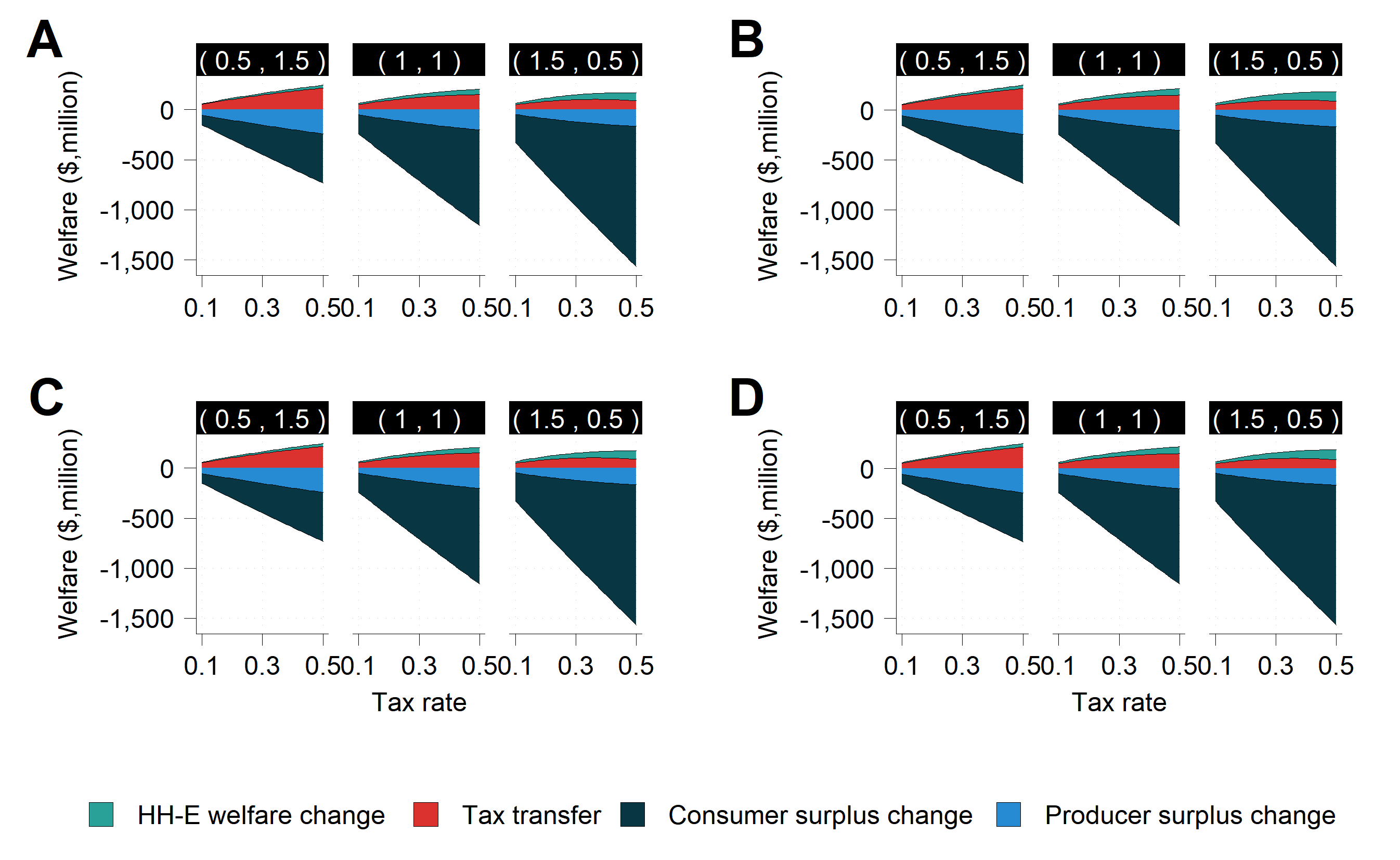

Fig. 4. Nation-level welfare effects. Welfare changes for a glyphosate tax ranging from 10 to 50% in the United States under four glyphosate damage scenarios: (A) no carcinogenic effect and no monarch butterfly effects, (B) carcinogenic effects only, (C) monarch butterfly effects only, and (D) both effects are assumed. Across scenarios, market economic welfare is identical, but HH-E welfare differs. Within each scenario, we present three combinations of glyphosate (Left) and the composite (Right) herbicide supply elasticity, namely, (0.5, 1.5), (1, 1), and (1.5, 0.5). The three combinations are selected because, all else equal, the (0.5, 1.5) combination gives the most conservative estimate of welfare loss (lower bound), while (1.5, 0.5) gives the most extreme welfare loss (upper bound). Market economic welfare change = consumer surplus change + producer surplus change + tax transfer.

Recommended citation

Ye, Z., Wu, F., and Hennessy, D. A. 2021. Environmental and economic concerns surrounding restrictions on glyphosate use in corn. Proceedings of the National Academy of Sciences, 118 (18).

Codes & Data availability

Codes and data are available here.

Media news

Economic impacts of glyphosate regulation.

correction: should be “glyphosate tax” instead of “carbon tax”